Exploring Vanguard’s Top Dividend ETFs: A Path to Passive Income

When it comes to building a reliable income stream through investments, exchange-traded funds (ETFs) that focus on dividends can be a smart choice. Among the plethora of options available, Vanguard stands out with its low-cost index funds that not only provide dividends but also offer long-term growth potential. In this article, we’ll delve into three notable Vanguard ETFs: the Vanguard Dividend Appreciation ETF, the Vanguard International High Dividend Yield ETF, and the Vanguard Real Estate ETF. Each of these funds has unique characteristics that cater to different investment strategies.

Vanguard Dividend Appreciation ETF (VIG)

At first glance, the Vanguard Dividend Appreciation ETF (NYSEMKT: VIG) may not seem like the most enticing option, boasting a yield of just 1.8%. However, this ETF focuses on companies that are likely to grow their dividends over time, making it an excellent choice for investors looking to build a passive income stream over the long term.

Growth-Oriented Approach

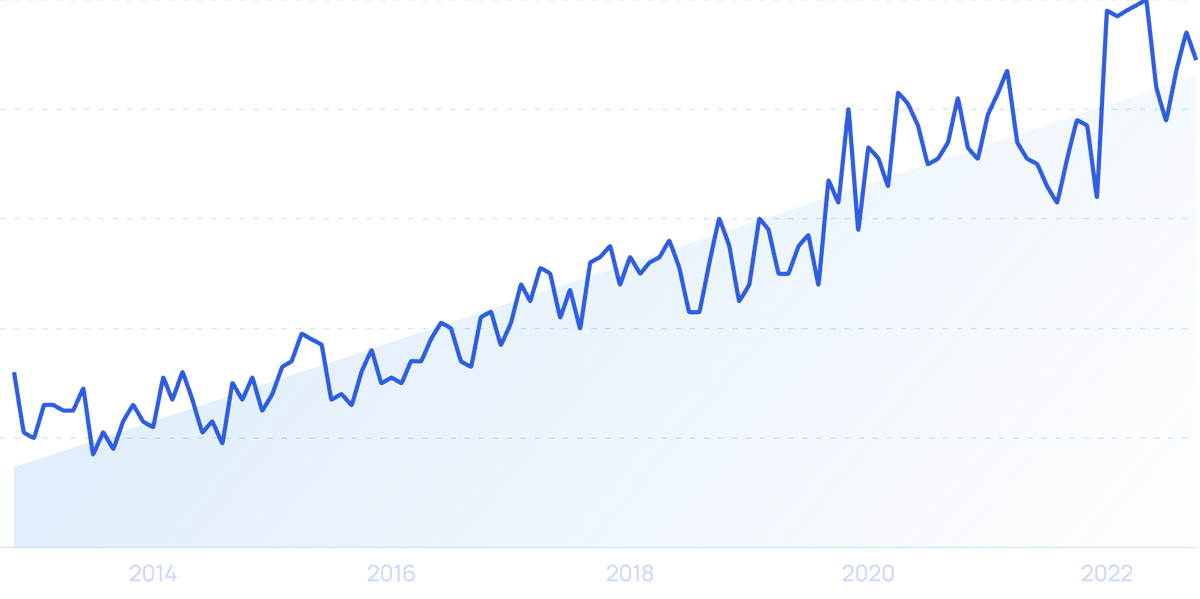

Unlike traditional income-focused ETFs, VIG leans towards growth. Its portfolio is heavily weighted in the technology sector, featuring top holdings like Apple (AAPL), Microsoft (MSFT), and Broadcom (AVGO). This growth orientation is reflected in its impressive performance, with an annualized total return of 11.2% over the past decade. Coupled with a remarkably low expense ratio of 0.05%, VIG allows investors to retain more of their gains.

Future Income Potential

For those who are still years away from retirement, VIG presents a compelling case. While its current yield may not be the highest, the potential for dividend growth means that the income generated from this ETF could significantly increase over time.

Vanguard International High Dividend Yield ETF (VYMI)

If you’re looking for a higher yield, the Vanguard International High Dividend Yield ETF (NASDAQ: VYMI) is worth considering. This fund tracks an index of non-U.S. companies that pay above-average dividends, currently offering a yield of 4.2%.

Diversification Benefits

Investing in international stocks can help diversify your portfolio and mitigate risks associated with U.S.-specific factors, such as trade tensions. VYMI holds a diverse array of 1,560 stocks, with top holdings including well-known companies like Toyota (TM), Shell (SHEL), and Unilever (UL). Notably, the average price-to-earnings (P/E) ratio for these international stocks is just 11.6, compared to 18.2 for their U.S. counterparts, indicating a potentially undervalued market.

Attractive Valuation

With international stocks trading at lower valuations, VYMI presents an appealing opportunity for investors looking to capitalize on global dividend-paying companies. This ETF not only provides a robust yield but also offers the potential for capital appreciation as these stocks gain traction.

Vanguard Real Estate ETF (VNQ)

The Vanguard Real Estate ETF (NYSEMKT: VNQ) is another intriguing option, particularly in the context of changing interest rates. While VNQ has underperformed in recent years, largely due to the prevailing interest rate environment, it could be poised for a turnaround as rates begin to fall.

Interest Rate Sensitivity

Real estate investment trusts (REITs) are highly sensitive to interest rate fluctuations. Lower interest rates can lead to cheaper borrowing costs for REITs, enhancing their profitability and driving up property values. As the consensus leans towards a downward trend in interest rates over the next few years, VNQ could become an attractive investment for long-term holders.

Long-Term Potential

Despite its recent underperformance, VNQ’s fundamentals remain strong. For investors with a long-term horizon, this ETF could represent a valuable addition to a diversified income portfolio, particularly as the real estate market adjusts to a more favorable interest rate environment.

Conclusion: A Balanced Approach to Income Investing

While there are numerous income ETFs available, Vanguard’s offerings stand out for their low costs and potential for long-term growth. The Vanguard Dividend Appreciation ETF is ideal for those focused on future income growth, while the Vanguard International High Dividend Yield ETF provides a robust yield and diversification benefits. Lastly, the Vanguard Real Estate ETF could be a strategic play as interest rates decline.

For investors looking to create a passive income stream that can withstand market fluctuations, these three Vanguard ETFs offer a balanced approach. As always, it’s crucial to conduct thorough research and consider your individual investment goals before making any decisions.