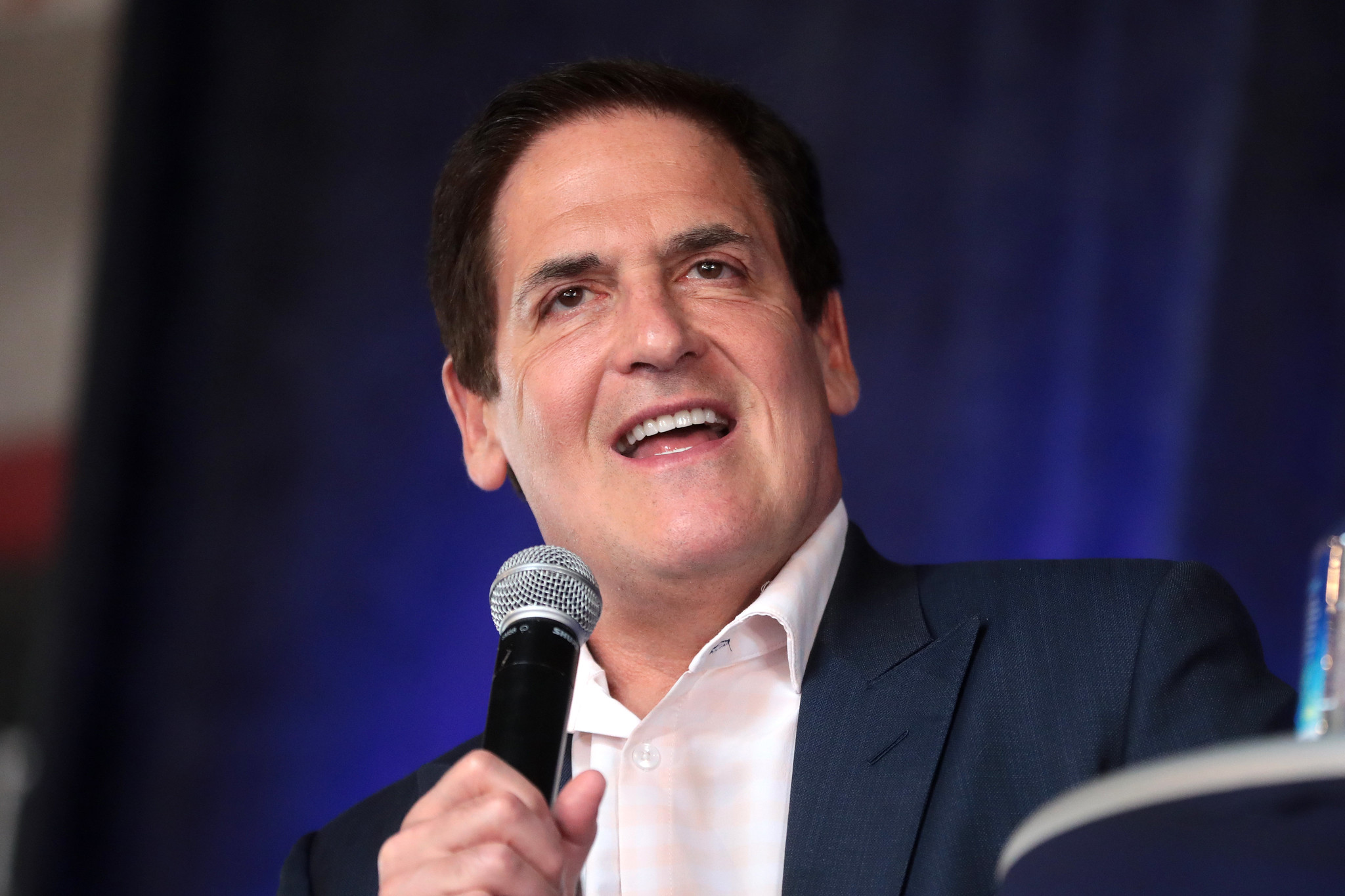

Mark Cuban, the well-known Shark Tank star and multi-billionaire entrepreneur, understands that not everyone has the means to invest millions in businesses or start their own successful companies. However, he believes that there are many ways to secure extra money through passive income streams without breaking the bank. In this article, we will explore seven strategies shared by Cuban to help individuals generate passive income and build wealth over time.

1. Invest in Stocks That Are Dividend Aristocrats

Cuban recommends investing in dividend-paying stocks, particularly those known as “dividend aristocrats.” These are companies that have consistently paid and increased their dividends each consecutive year for at least 25 years. Examples of dividend aristocrats include Coca-Cola, Chevron, and Walmart. By investing in these companies, investors can receive regular dividend payouts, which can be monthly or quarterly, depending on the company. To maximize the compounding effect on your portfolio and accelerate growth, Cuban suggests reinvesting the dividend income into buying more stocks.

2. Gain Exposure To The S&P 500 Index

Cuban believes that the S&P 500 Index offers a reliable path to wealth accumulation. This index tracks the performance of the largest 500 companies in the US and has historically delivered annual average returns of around 10%. While the index is up over 21% year-to-date, it is essential to consider inflation-adjusted returns to get a more accurate picture of your investment’s growth potential.

3. Identify Low-Cost Mutual Funds

Investing in low-cost mutual funds is another strategy recommended by Cuban to generate passive income. These funds pool investor money and invest it across various industries and asset classes to diversify and mitigate market risks. Before investing, Cuban advises checking the fees associated with the funds, particularly the expense ratio. A reasonable expense ratio is typically between 0.5% and 0.75%, as anything higher could significantly impact capital gains.

4. Explore Secure Options Like A High Yield Savings Account

While saving money is essential, Cuban emphasizes the importance of ensuring that your savings are growing over time. One way to achieve this is by parking your cash in a high-yield savings account. These accounts offer higher interest rates on deposits compared to traditional savings accounts, providing a more significant return on your savings.

5. Real Estate Investing, Fractional Shares

For individuals looking to invest in real estate but may not have the capital to purchase properties outright, Cuban suggests exploring fractional shares and real estate investment trusts (REITs). Fractional shares allow investors to buy portions of a share at a reduced cost, while REITs enable individuals to invest in commercial or residential properties through online crowdfunding platforms for rental income and capital appreciation.

6. Explore Peer-to-Peer (P2P) Lending

Investing in debt, particularly through peer-to-peer lending platforms, can provide a stable monthly income from interest payments. While there are risks associated with lending to borrowers, choosing lower-risk profiles can help mitigate potential defaults and create a reliable passive income stream.

7. Take Calculated Risks In Things You Believe

Lastly, Cuban encourages individuals to consider investing in causes, companies, or assets they believe in, even if they carry some level of risk. Whether it’s investing in art, collectibles, or emerging technologies, taking calculated risks in assets with growth potential can lead to significant returns over time.

In conclusion, Mark Cuban’s strategies for generating passive income offer individuals a range of options to build wealth and secure financial stability. By diversifying investments, reinvesting dividends, and exploring alternative investment opportunities, individuals can create multiple streams of income and work towards achieving their financial goals.